Home > Success stories >

Digital Pixel: breaking into the Middle East with UK Export Finance support

Digital Pixel secures first contract in the Middle East, insured with the government’s Small Export Builder.

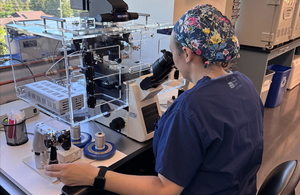

Digital Pixel is a pioneer in advanced microscopy incubation systems, enabling scientists to observe live cells under the microscope. Based in Brighton, the four-person business has more than 20 years’ experience at the cutting edge of scientific imaging research.

The company supplies prestigious institutions including Cancer Research UK and the universities of Cambridge, Oxford, Heidelberg and Paris. Digital Pixel has been exporting for 15 years, with customers across the UK, Europe and Australia.

The challenge

Digital Pixel was presented with an opportunity to supply parts for a high-resolution microscope to a medical school in Saudi Arabia. This would be the company’s first contract in the Middle East, in a market where it had no existing trading relationship.

As a small business entering an unfamiliar market, Digital Pixel struggled to obtain commercial export insurance. Without cover in place, the financial risk of taking on a new overseas buyer was too great to manage alone.

The solution

Digital Pixel applied for UK Export Finance’s Export Insurance Policy and was granted an initial credit limit of £12,150. This automatically made the company eligible for UKEF’s Small Export Builder.

The SEB allows small businesses in all sectors to access export insurance with credit limits of up to £25,000, which can then build incrementally to £100,000 as they establish a positive trading history with overseas buyers. This flexible approach gave Digital Pixel the confidence to proceed with the Saudi Arabian contract while managing the risk effectively.

The impact

With UK Export Finance backing, Digital Pixel successfully secured its first Middle Eastern contract, marking a significant milestone in the company’s international growth. The deal represents a foothold in Saudi Arabia and could pave the way for further expansion across the region.

The business now expects to reach £250,000 in export sales this financial year, demonstrating how the Small Export Builder insurance product is helping innovative UK SMEs compete globally and enter new markets with confidence.

As a small business, taking on a new buyer in an unfamiliar market involved risks we simply couldn’t manage alone. UK Export Finance’s Small Export Builder has given us the confidence to expand our trading relationships and take on orders from clients in markets that are new to us.

Export Insurance Policy

Get insurance against the risk of not being paid when doing business in emerging or developing markets.